If you want to get a Telenor withholding tax certificate. Stay with us because here we will tell you how you can get a tax certificate. So let’s start without wasting time.

There are two ways you can get a Telenor tax certificate. The first method is online and the second method is offline. Let me tell you both ways. First, we will learn about the online method.

How to Get Telenor Tax Certificate Online

Telenor does not offer an online tax certificate. But I have come up with a way for you. With the help of which you will be able to get an online tax certificate very easily. Just need a few things that are mentioned below.

- Scanned CNIC images of both sides.

- Telenor number.

- Year: example (2019 to 2020).

- Email address.

If you have the above three things then you are ready to get the certificate. So let me tell you to step by step how to get it.

Step 1:

First, go to the Telenor website and click on the live chat option.

Step 2:

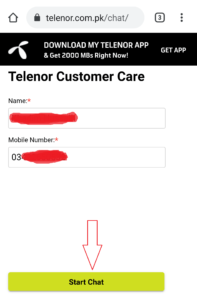

A new tab will open in which you have to enter your name in the first box and your mobile number in the second box and then click on the start chat button below.

Step 3:

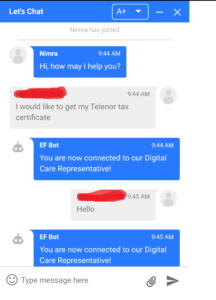

Live chat will now open in front of you. Now message them that I want to get my tax certificate. they will ask you to send the scanned CNIC images of both sides, mobile number, year, and email address. You send them all the details.

You will receive your tax certificate via email shortly.

Get Tax Certificate Offline

You can also get a Telenor tax certificate by visit the nearest Telenor franchise. and if you want, you can get it by calling the Telenor Helpline 345. There is no other way.

Conclusion

If you have received a Telenor tax certificate with the help of our post, please let us know by commenting below. If there is any problem, let us know. And if you like it, share it with others

Also read:

I need With-Holding Tax Statement for the period of 1-7-2020 to 31-05-2021

follow main bataye tarike ko follow karo

Hallow,

Telenor team as your competitors give us platform to get certificate via jazz world easily, but in your side there is no any version in My Telenor app why????

Getting a withholding certificate on mobile use from telenor is an awful experience. Its Android application can easily provide this facility like Jazz,

Ufone and Zhong. Telenore is losing its customers due to its non co operation to its customers. So sad.

I need my withholding tax certificate for tax year 2021

Telenor ke agent se live chat karo ya 345 par call karo wo apki madad kare ge

kindly send to me tax certificate 2021 of 03422037401

aap post me diye gaye tarike ko follow kar ke telenor ka tax certificate hasil kar sakte ho.

I need my withholding tax certificate for tax year 2021

Jis sim ka aap tax certificate hasil karna chahte hai iche click kar ke post main bataye method ka use karen.

Jazz Tax Certificate

Telenor Tax Certificate

Zong Tax Certificate

Ufone Tax Certificate

Great

I got my tax certificate online withon 3 minutes. Thank you very much for the easiest way of geeting the tax certificate online rom telenor.